Content

Most accounting software will automatically import your bank data so you don’t have to manually enter and organize each transaction. If you’re using spreadsheet software as your GL, you’ll need to enter each transaction by hand. Alternatively, you can pay an accountant, bookkeeper, or outsourced accounting company to manage your accounts and ledger for you.

Wave is best for small businesses on a tight budget that still want strong accounting capabilities. This software is ideal for Etsy sellers and micro businesses.

What Does a Debit Balance in the General Ledger Mean?

Technically, Canadians are required to use the accrual method. To simplify things, you can use the cash method throughout the year and then make a single adjusting entry at year end to account for outstanding receivables and payables for tax purposes. To open a business bank account, you’ll need a business name, and you might have to be registered with your state or province. Check with the individual bank for which documents to bring to the appointment.

- This information can be recorded manually or digitally, but most people opt fordigital bookkeeping, which often leverages automation to cut down on the more tedious aspects of managing the books.

- When I will add the seamless customer support on this, you have the full package.

- Other transactions might affect only two accounts, such as a rent payment.

- You can also browse the Shopify App store for an accounting software that will seamlessly integrate with your ecommerce store.

- Liabilities are what the company owes like what they owe to their suppliers, bank and business loans, mortgages, and any other debt on the books.

- Liabilities are claims based on what you owe vendors and lenders.

Mixing together personal and business expenses in the same account can also result in unnecessary stress when you need to file taxes or do your bookkeeping. It could mean a business expense gets lost in your personal account and you miss out on an important deduction. Or it could mean your CPA spends more time doing your taxes. If you wait until the end of the year to reconcile or get your financial transactions in order, you won’t know if you or your bank made a mistake until you’re buried in paperwork at tax time.

Do you have the right personality for College?

If you’re looking for easy accounting software, ZipBooks is hard to beat. With a great design and good learning resources, ZipBooks does everything it can to make accounting simple. If ZipBooks sounds like a good fit for your business, use the free plan to take the software for a spin. If you’re a freelancer looking for a way to manage your finances and taxes, https://www.bookstime.com/ QuickBooks Self-Employed could be a good option for your business. The software is easy to use, and the QuickBooks app allows for quick access to your data. QuickBooks Online is a fully-featured accounting software program that is generally easy to use. With over 600 integrations, strong mobile apps, and tax support, it’s no wonder this software is popular.

Popular options include Patriot, Wave, QuickBooks Online, QuickBooks Pro, and Xero. One thing to note is that in most cases, an additional fee is required for payroll services in addition to the fees you pay for your accounting software. Xero is a major player in the business accounting software space.

What does an accountant do for a small business?

However, Xero is a great match for those growing businesses or startups whose accounting needs have outstripped their current system’s capabilities. If you’ve got the budget for it, Xero would make a great asset to your growing business. Sage Business Cloud Accounting is a great solution for small businesses looking to handle basic accounting and invoicing for their company. Recent upgrades to the software have made this program more user-friendly and feature-rich.

- For every active account you use, such as cash, accounts payable and accounts receivable, you’ll have separate journals for each one.

- We are here for businesses that need payroll software or own multiple businesses with lots of products and services.

- Zoho Books offers unbeatable invoicing and strong mobile apps.

- In this plan, payroll is full-service, which means that all tax filings and payments are completely managed by Wave.

- Or it could mean your CPA spends more time doing your taxes.

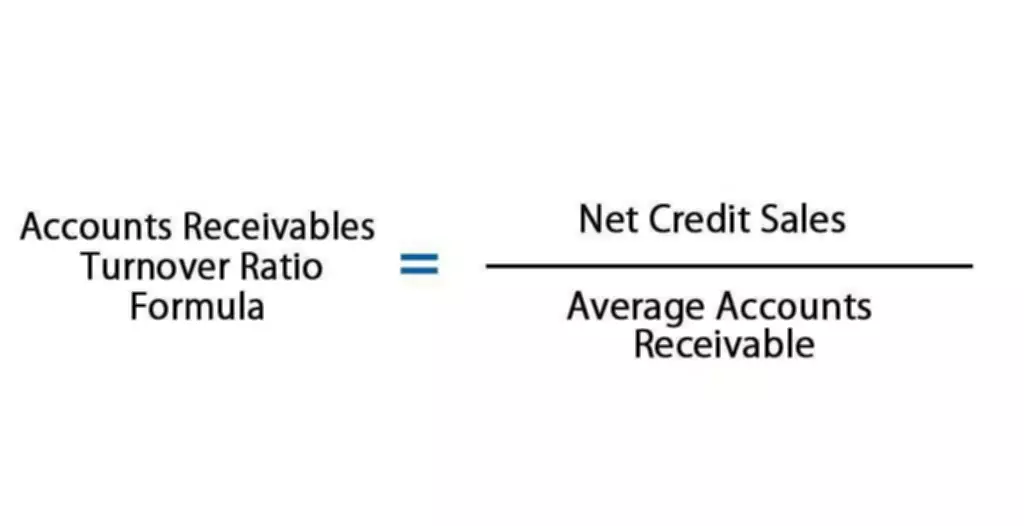

- You can also generate reports such as accounts receivable, balance sheets, sales tax reports, and accounts payable.

- Make sure you pay attention to when your receivables are due and don’t waste time when they’re overdue – act right away.

This chart aligns your financial structure by recording the income and expenses of the company. Ultimately, the decision will come down to your budget and the features your business needs. LessAccounting is 100% web-based, meaning it can be accessed from anywhere and there’s no software to install on your computer. You can easily use LessAccounting on your iPhone or any Android mobile device with our cloud accounting. That is what makes it the best small business accounting software options among accounting programs. We cater to thousands of users with our cloud-based accounting. Although we don’t have mobile apps, our website is very convenient.

Part 3 of 3:Posting Transactions to a Ledger

• Short-term liabilities are defined as amounts that are due within one year. Examples of short-term liabilities what is bookkeeping are accounts payable, payroll tax liabilities, and the portion of the long-term debt that is owed for that year.

- Asset accounts start with the cash account since cash is perfectly liquid.

- It’s a reason why you should have organized financial reports and separate bank accounts.

- Every business owner needs good accounting software to remove manual data entry and save time.

- It’s full of useful tips on why doing your own books is important, how you can get started, the best way to maintain it, what to look for in software plus so much more.

- To efficiently keep track of spending, you can create a budget or use an accounting software.